massachusetts estate tax rates table

Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes for free. For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40.

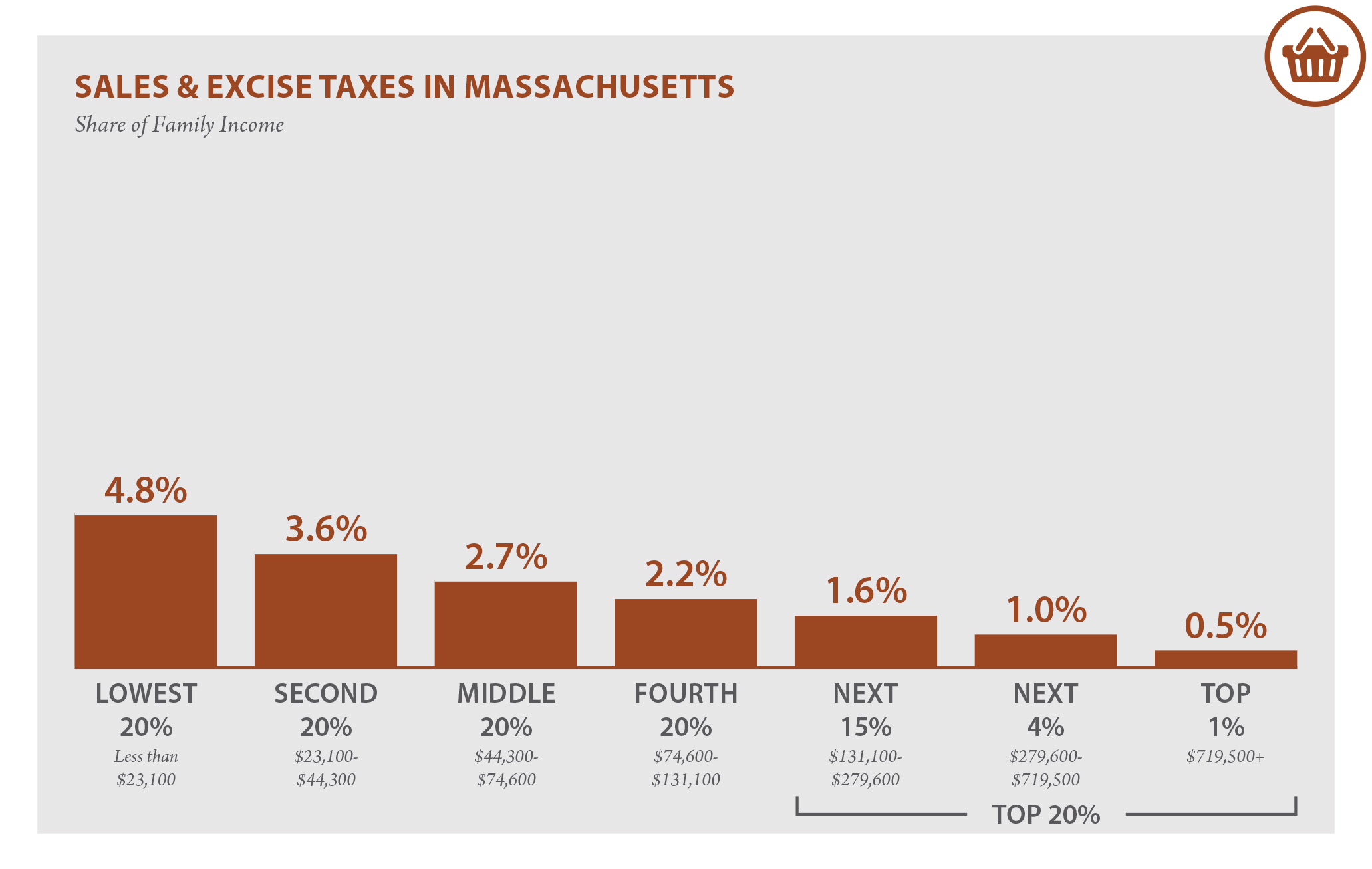

How Do State And Local Sales Taxes Work Tax Policy Center

A state sales tax.

. Generally Massachusetts is a high tax state and the average homeowner pays 114 of their home value. Up to 25 cash back In Massachusetts the estate tax rate is based on a historical federal credit for state death taxes. The table below lists all of the.

Additionally because the taxable estate of. Sales rate is in the top-20 lowest in the US. To find out the exact state estate tax owed in 2021 see the.

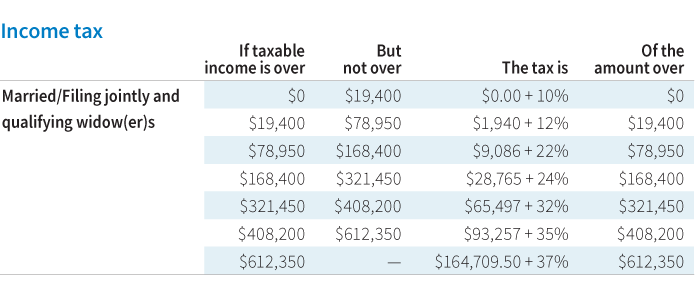

A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. The estate rate tax depends on the size of the estate. The Massachusetts State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Massachusetts State Tax CalculatorWe.

The Massachusetts income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. Only to be used prior to the due. The adjusted taxable estate used in determining the allowable credit for state death.

Compared to other states. The Massachusetts estate tax for a resident decedent generally. 2022 Massachusetts Property Tax Rates.

This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Detailed Massachusetts state income tax rates and brackets are available. Of that 167 billion or 216 of the total revenue collected is from property taxes.

A guide to estate taxes Mass Department of Revenue. The full table of Massachusetts estate tax rates is available in the states guide to estate taxes. Massachusetts estate tax rates table Monday March 21 2022 Edit Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with.

Which Towns have the Highest Property Tax Rates in Massachusetts. A local option for cities or towns. Only to be used prior to the due date of the M-706 or on a valid Extension.

A state excise tax. But dont forget estate tax that is assessed at the state level. Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien and Guidelines.

2022 Property Tax Rates. The filing threshold for 2022 is 12060000. 2022 Massachusetts Property Tax Rates.

Longmeadow has the highest property tax rate in Massachusetts with a property tax rate of 2464. The Massachusetts estate tax is an amount equal to the federal credit for state death taxes computed using the Internal Revenue Code Code as in effect on December 31. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or.

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns. More details on estate taxes in Massachusetts are.

Exploring The Estate Tax Part 1 Journal Of Accountancy

Estate Tax In Massachusetts Slnlaw

Massachusetts Who Pays 6th Edition Itep

A Guide To Estate Taxes Mass Gov

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Irs Announces Higher Estate And Gift Tax Limits For 2020

Massachusetts Who Pays 6th Edition Itep

State Tax Levels In The United States Wikipedia

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

How Do Millionaires And Billionaires Avoid Estate Taxes

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group